The best way how to find stocks to buy is to use the Investor’s Business Weekly newspaper (IBD):

You can also buy a digital version at investors.com. IBD rates the stocks from 1 to 99 the so called Composite Rating. This based on the CANSLIM method created by Investor’s Business Daily founder William J. O’Neil. We recommend to read his bestselling book. You find a link in this blog. There are also some newer guides we like:

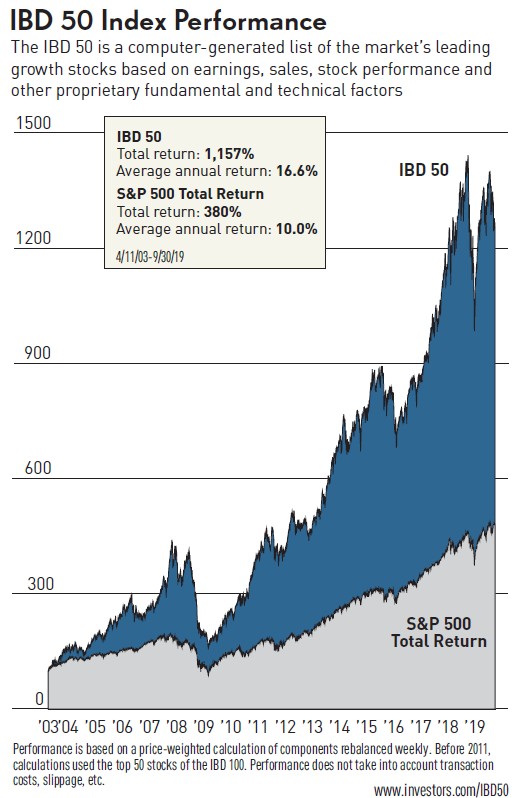

In the IBD newspaper you find a detailed list of the top IBD 50 stocks. All this stocks meets the CANSLIM criteria and have a good composite rating usually above 90. You see in the chart below the out performance versus the S&P 500. The average annual return of the S&P was 10% and the IBD 50 16.6%. The selection of tested fundamental criteria is the key. Of course you see that the drawdown of the IBD 50 list in market corrections was greater than the S&P 500. What goes well is what gives off the most. For this you need our Market Models.

If you have a subscription to the digital version of the IBD you can download the IBD 50 stock list. You can test it for a few bucks. We use the extended IBD 200 stock list for more candidates to buy.

In the next step, we use the LoroScanner to select stocks witch meets following criteria:

As you can see we are looking for stocks with a smooth uptrend (ROC / UI = Rate of Change / Ulcer Index) and above their stop. So we combine fundamental (IBD) with technical criteria.