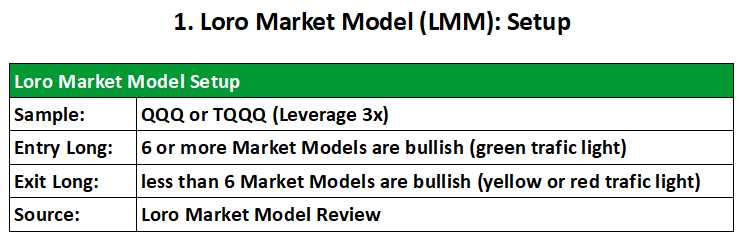

In this new series, we present our ETF models from our Signal Service. For every Model, we show the setup and the backtest.

Today we look at the Loro Market Model (LMM).

Our 10 market models help you to time the market. In our Weekly Market Models Review, we publish every week all information you need. If the Trafic Light switch to a new color we will send a warning to our subscribers. You get the warning in our Signal Service too.

The Setup for our ETF model is very simple, if the traffic light is green you buy the Nasdaq 100 ETF QQQ or the 3x leveraged ETF TQQQ, if not, you sell your position.

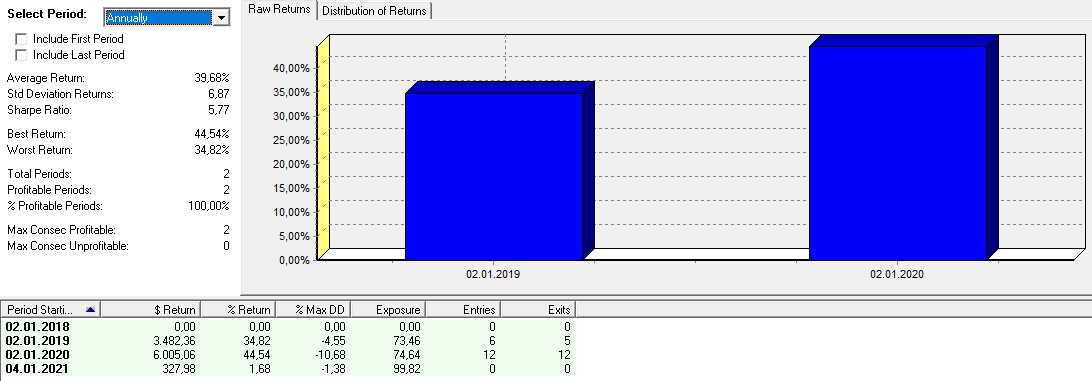

With the QQQ you got in the backtest 2019 34.82% and a max. Drawdown of -4.55%, and 2020 44.54% and a max. Drawdown of -10.68%. This give us an excellent reward risk ratio of 3.72 (avg. profit 39.68% / max. Drawdown 10.68%). Unfortunately we can’t do longer backtests because we are missing some data. 2017 was easy, the traffic light was green all the time, and the QQQ made a performance of 31.47%.

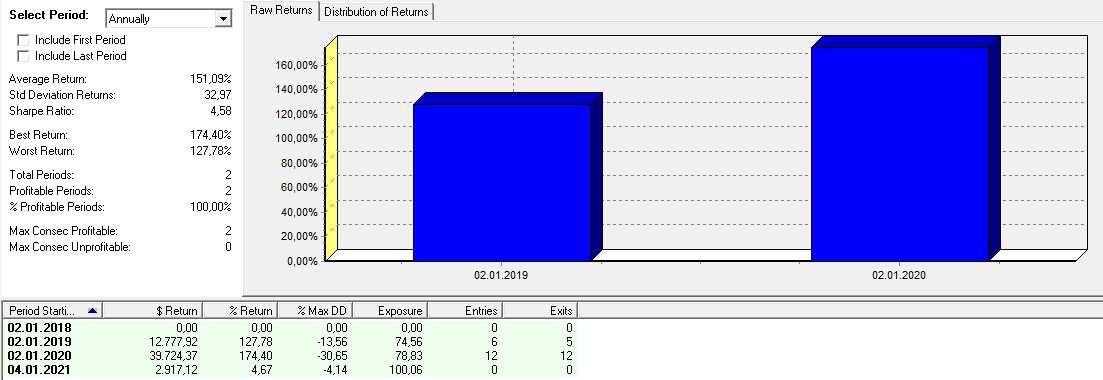

The result was even better with the TQQQ, you got 2019 127.78% and a max. Drawdown of -13.56%, and 2020 174.40% and a max. Drawdown of -30.65%. The reward risk ratio was 4.93 (avg. profit 151.09% / max. Drawdown 30.65%). If you use only one third position size in TQQQ you have more performance as you trade QQQ with the fill size.