If you want to learn how to make money with stocks, the best way is to watch how professional traders do. So for demonstration purposes, we started 2020 with a real money depot.

In Part 5 of how to trade stocks, we show how the corona crash affected our real money stocks depot and what we will do in April.

1. What are the results of the stock market in March 2020?

March 2020 was a terrible and a historical month for the stock market. The S&P 500 dived deep about -30%. See the video below. After this we have a bear market rally.

2. How did we do it in our real money depot?

We didn’t follow the corona crash. Our Market Models have generated an exit signal in the opening of 25. February and after that, we did only some options strategies.

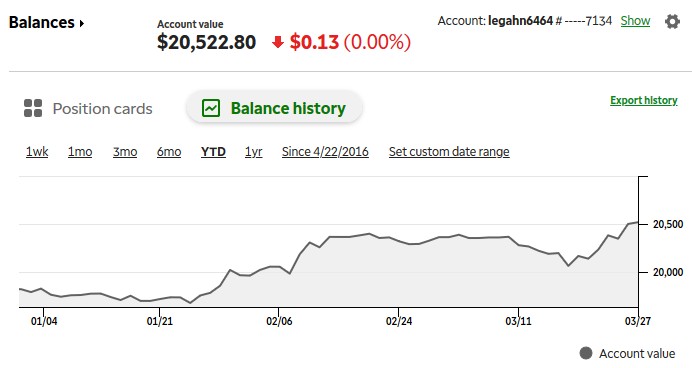

Our year to date performance is +3.5%. You can be very proud if you don’t have lost money in this market crash! Look at our balance in our TD Ameritrade account:

3. What we will do in April

Maybe cash is king now, but we want our money to work. So we will start our Loro’s Adaptive Asset Allocation Model (LAAA). For this trading system, we will use half of our balance. The LAAA Model makes each end of the month a dynamic allocation in 20+ Years Treasury Bonds (TLT), Nasdaq 100 (QQQ), and Gold (GLD).

In the backtest below, you see that every year this system made money, and on average, 11.34%. In the corana crash, this system made 5.32%!

The maximum drawdown was this year, but only -13.5%. In praxis, we use additional exit rules and hedging strategies to reduce this maximum drawdown.

At the end of March, we will start our LAAA Model. We use our software to get the best allocation of TLT, QQQ and GLD.