If you want to learn how to make money with stocks and options, the best way is to watch how professional traders do. So for demonstration purposes, we started 2020 with a real money depot.

In this post – real money depot part 7 – we analyze our current depot situation for August 2020 with the ThinkOrSwim platform.

1. What positions we have in our depot?

13 Post Earnings Butterflies: ABT, EA, EBAY, IBM, NFLX, MA, MMM, MSFT, PEP, PYPL, SBUX, TWTR, V

2 double Eagle: WMT, HD

1 Netzero: SPY

Hedge:

2 SPX Sep Teenys

2 August Calendar SPX: 3000, 3100

1 The Great Wave

2. How does our depot look like?

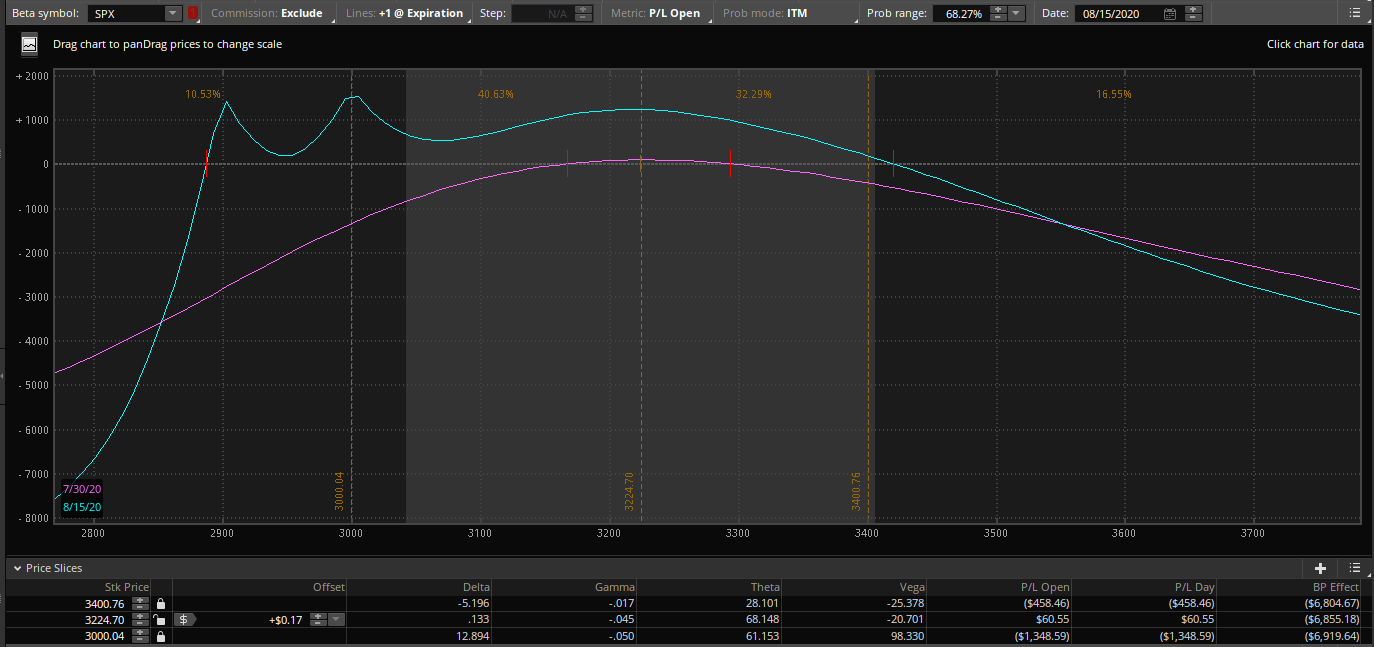

With the ThinkOrSwim Platform (TOS) we can do a portfolio analysis. In the graph below, you see our Profit/Loss-diagram (Beta Symbol SPX). Our delta at the money (3225) is near zero, we are delta-neutral. Our theta shows that we have at the money a time decay of +68$ for the next day. If the SPX closed between the first standard deviation at expiry 15. August out depot makes money, at the money about 1k$.

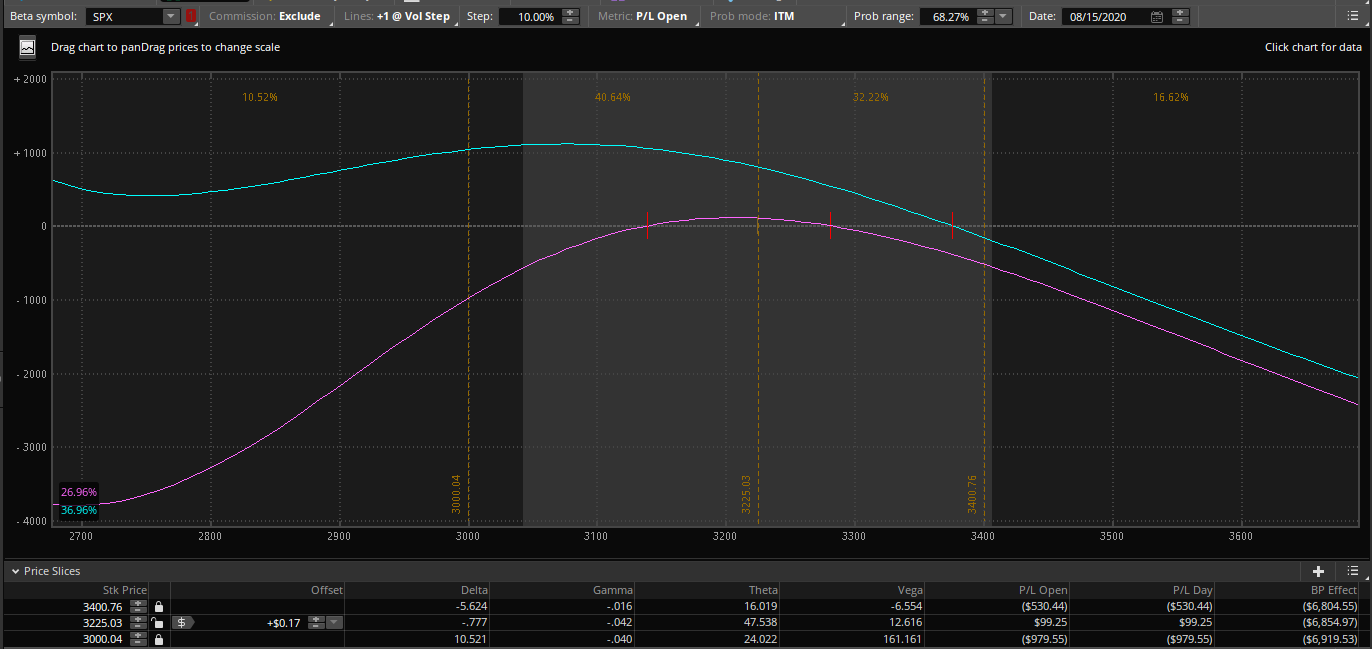

If the market goes down the volatility will goes up. So it is great we have positive Vega on the downside, near 3000 a vega of +98. In the next graph you see the effect if the volatility change to +10%. We don’t have any downside risk.

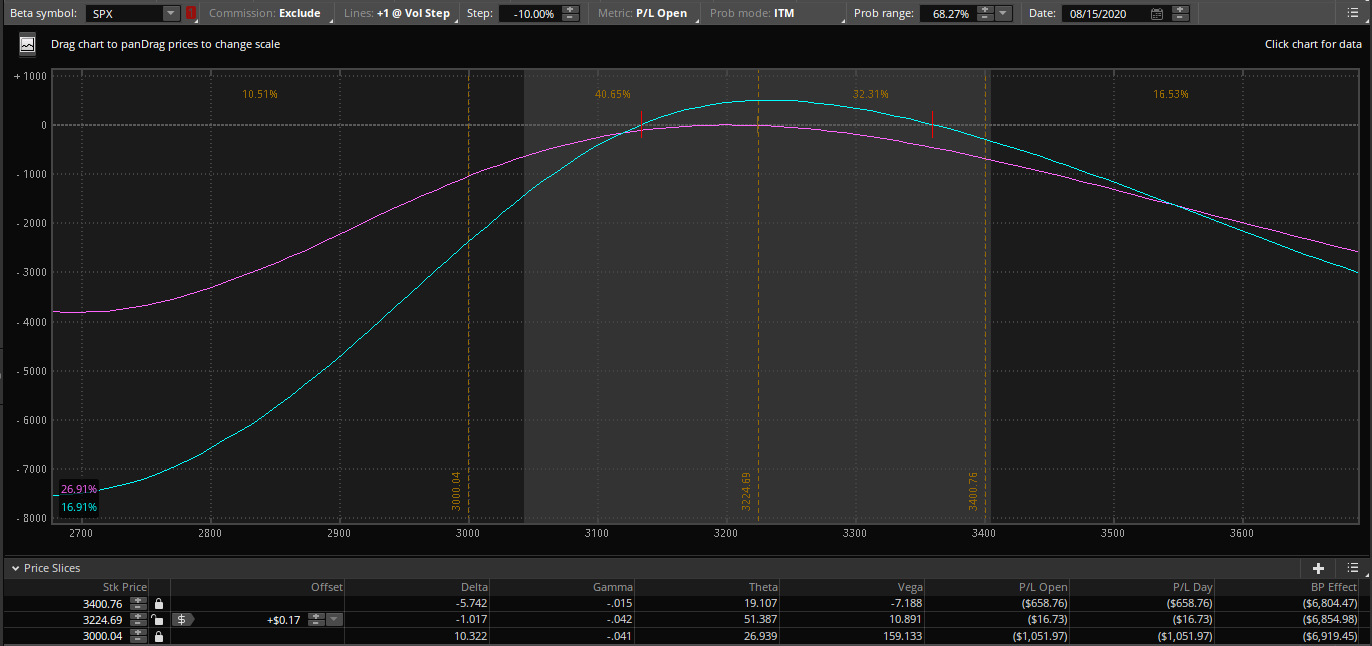

If the market goes up the volatility will rise. So it is great we have negative Vega on the upside, near 3400 a vega of -25. In the next graph you see the effect if the volatility change to -10%. We don’t have any upside risk below 3400, the last local high of the SPX. If we go over 3400 we have to repair our posetions. but this is not very difficult.

If you can handle this portfolio analysis you can beat the market where ever he goes.