If you want to learn how to make money with stocks, the best way is to watch how professional traders do. So for demonstration purposes, we started 2020 with a real money depot.

In this post – how to trade stocks part 6 – we show the balance history and some strategies of our real money depot for the first half of 2020.

1. What are the results of the stock market in March 2020?

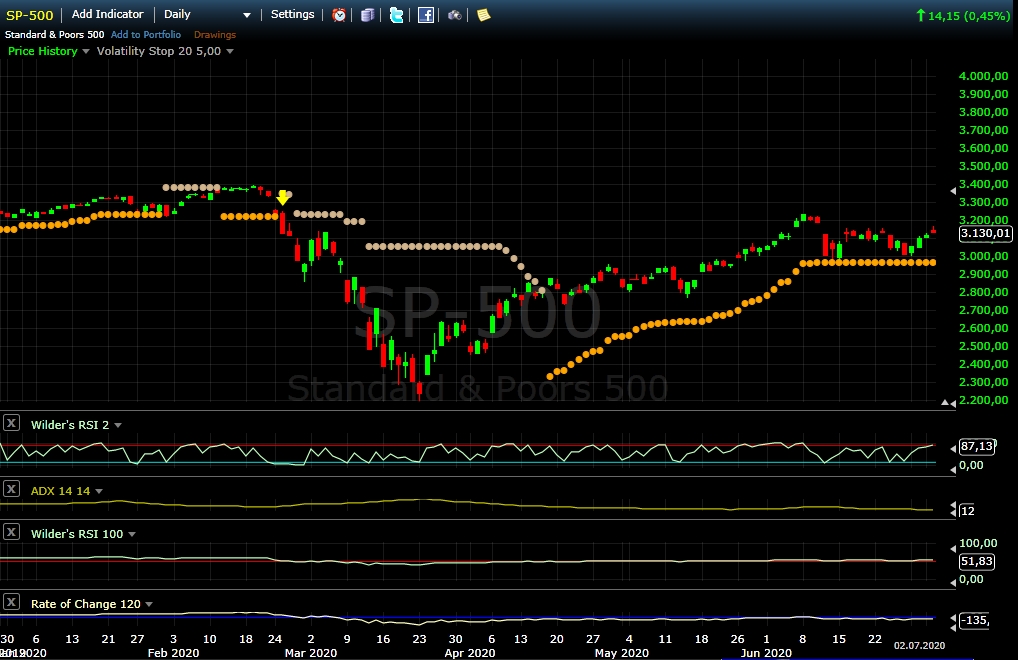

The S&P 500 dived deep about -34%. After thas, we have seen a V-shaped recovery. The Year to Date Performance is -3.12%:

2. How did we do it in our real money depot?

We didn’t follow the corona crash. Our Market Models have generated an exit signal in the opening of 25. February and after that, we did only some options strategies.

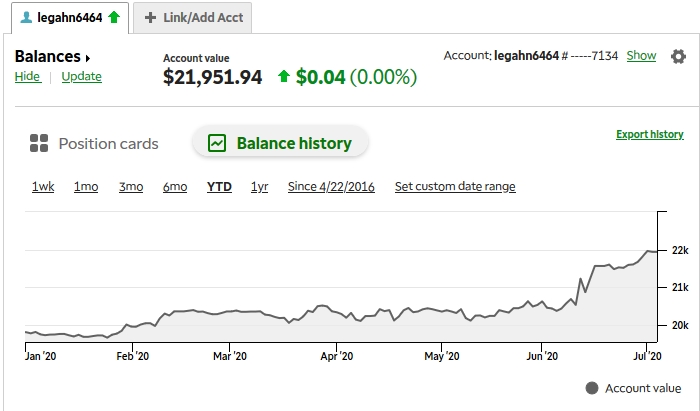

Our year to date performance is +10.73%. But more importantly, our maximal drawdown was only -2%. Our Reward Risk Ratio is 10.73/2 = 5.37. That’s awesome!

If you have a risk tolerance of -10%, you can leverage this reward to 53.65%. That’s over 100% per year. Below you see the balance of our TD Ameritrade account:

3. How did our strategies this year?

Loro’s Adaptive Asset Allocation Model (LAAA): This strategy makes each end of the month a dynamic allocation in 20+ Years Treasury Bonds (TLT), Nasdaq 100 (QQQ), and Gold (GLD). This year this system made 15.68%, but generated a new maximum drawdown of -13.54%. Below you see the backtest:

Loro’s Bond Rotation (LBR): This strategy makes each end of the week an allocation in 2 Bond ETFs. This year this system made 3.4%, but generated also a new maximum drawdown of -12.74%. Below you see the backtest:

In the second half of 2020 we will do more swing trades with our Loro Stock Model (LSM) and our Loro ETF Model (LEM). We will complete this with short selling of Robinhood hip stocks.