How to find stocks for Earnings Trades? Today we show how you can select stocks for earnings trades? Find the next earnings date for your options trade.

1. Find the next Earnings Date

First of all, you have to find the next earnings announcement Date for a given stock. It is also essential to know if the announcement is after close or before opening and if the statement is confirmed or not confirmed?

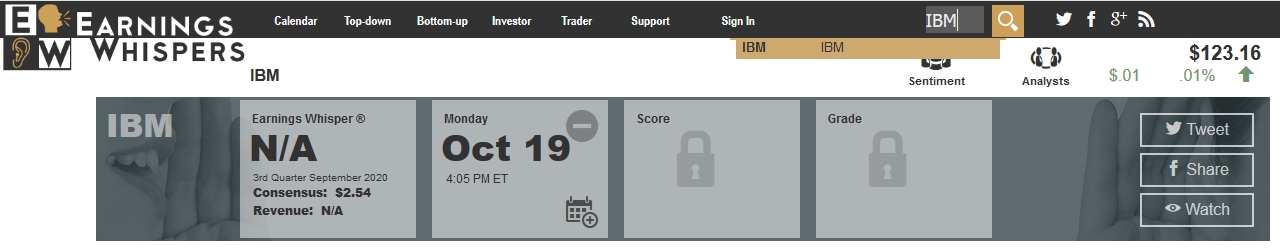

In earningswhispers.com you get this information easily for every stock ticker:

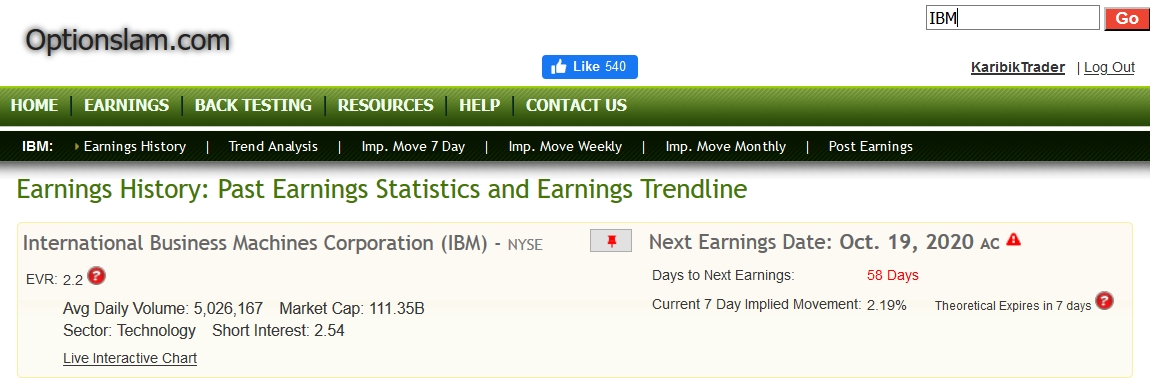

An other execellent page is Optionslam.com. If you have a account you find historical earnings dates too.

If you have the Loro Scanner you can easy scan your stock lists and sort by earnings dates:

2. Make your Options Trade

If you have found the earnings announcement date and have checked if this will happen after close or before opening, and if this is confirmed, you can select your options strategy. There are three types of earnings strategies. All of them use the edge of volatility:

Pre Earnings Announcement Strategies: here you open and close the option trade before the earnings. Because the volatility will rise before earnings use vega positiv strategies. We love Double Calendars.

Through Earnings Announcement Strategies: here you open the option trade before and close is after the earnings. Because the volatility will fall after earnings use vega negativ strategies.

Post Earnings Announcement Strategies: here you open the option after the earnings. Because the volatility will fall after earnings use vega negativ strategies. We love directional Butterflys.