How to find stocks for Options Trades? Today we show how you can select stocks for options trades? Find stocks with liquid options and check the volatility. For ETFs, the process is the same.

1. Liquidity

First of all, we search only stocks they have liquid options. A good start is a list of stocks they have weekly options. You can download the list from the Chicago Board Options Exchange (CBOE). Today there are 83 ETFs and 487 stocks with weekly options.

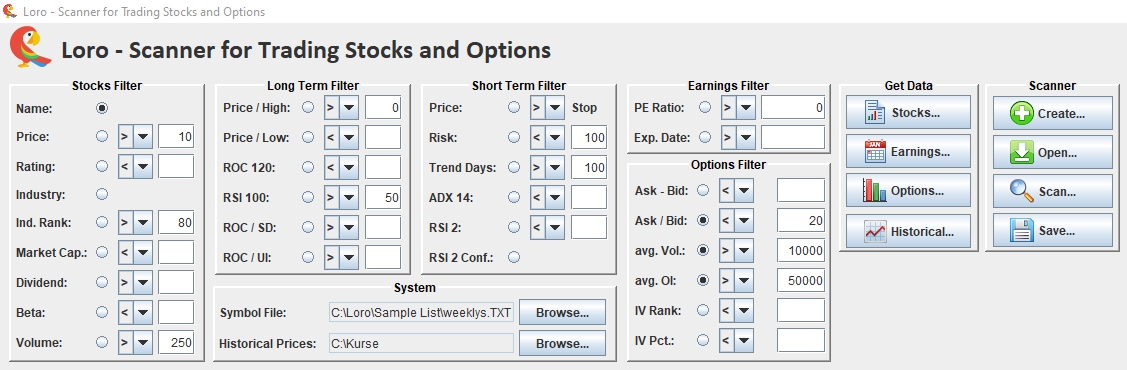

Next, we copy the symbols of the list to an ASCII file. This file we can import in the Loro Scanner to check the liquidity of the options for every stock. We prefer stocks with a bid / ask difference < 20%, an one-week average options volume > 10k and open interest > 50k. See the screenshot below. After the Scan about the half of the weekly list remains.

2. Volatility

For an option trader volatility is key. You have to know if the vola is relatively high or low for every stock in your list. The best way is to use the IV-Rank and IV-Percentile: The IV-Rank compares the current level of the implied volatility relative to the IV range over the past 52-weeks. And the IV-Percentile calculates the percentage of days in the past 52-weeks in which the IV was lower than the current level.

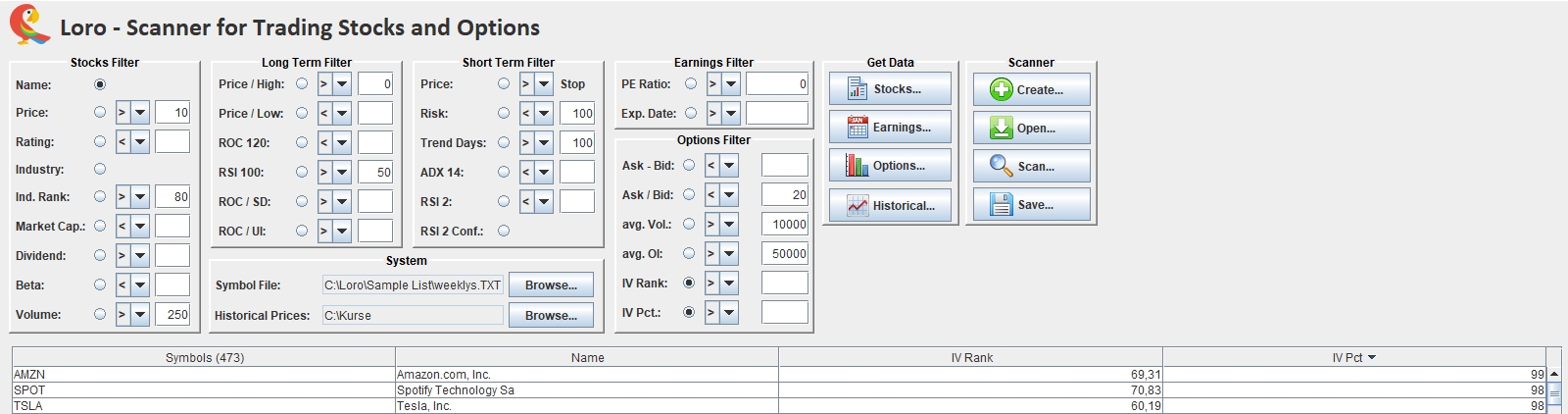

Again the Loro Scanner helps us. We can easily scan our stock list with liquid options for IV-Rank and IV-Percentile. In the next screenshot, you see some results sorted by IV-Percentile. AMZN, SPOT, and TSLA have the highest score because their earnings are near: