In this post – options trading part 4 – we show how to make money in a stock market correction. We use Calendar Spreads and Teenys.

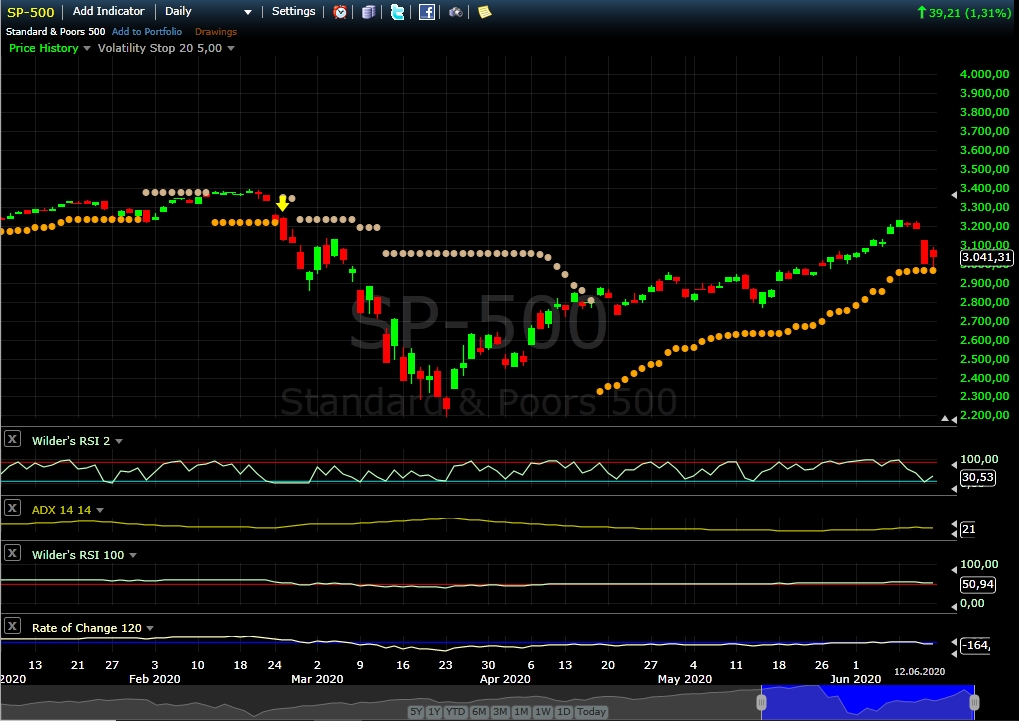

After the corona crash 2020, we had seen a nice run on the upside in the S&P 500. Our Market Models switched to bull market on 17. April.

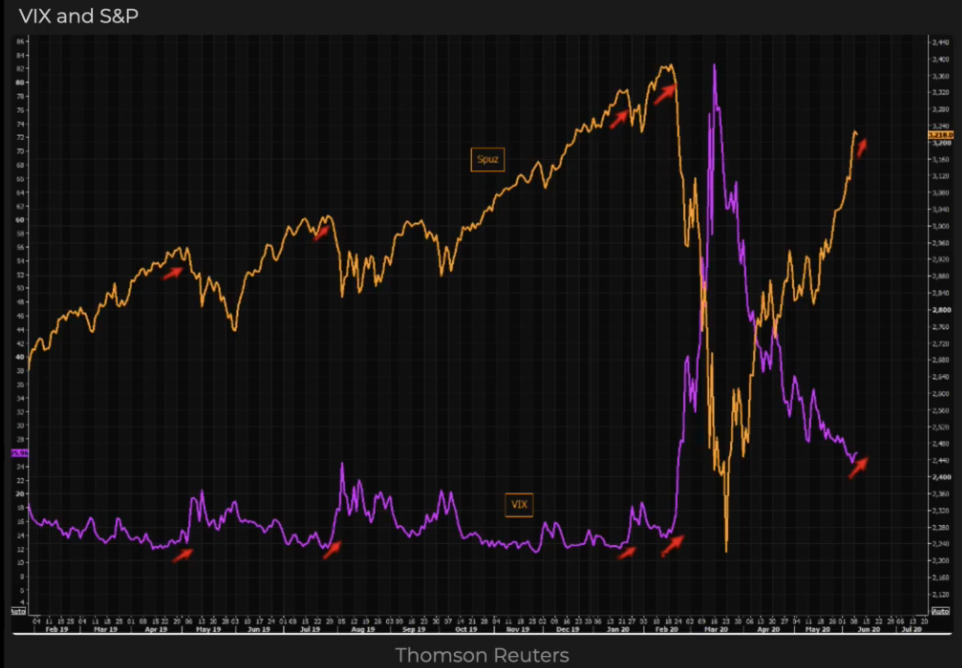

On Mondey 8. June we saw a critical pattern. Look at the end of day results in some ETFs: IWM +1,8%; SPY +0.89; TLT +0.24; GLD +1.11%; VXX +2.4%. If the stock markets goes up and the volatility goes up too, this is a clear warning signal. In the next graph you see this green convergences (red arrows) in the volatility index (VIX, purple line) versus the S&P500 (yellow line). After every pattern followed a correction:

So we came to the conclusion its better to hedge more our real money depot.

1. Teenys

We really like this hedge strategy because its very simple. We bought some July monthly puts with strike 2000 for 110$ each.

2. Calendar Spreads

Calendar Spreads are nice because the rise if the volatility goes up. We bougth some weekend calendars: sell 19. June and buy 22. June, strike 2900 and 3100.

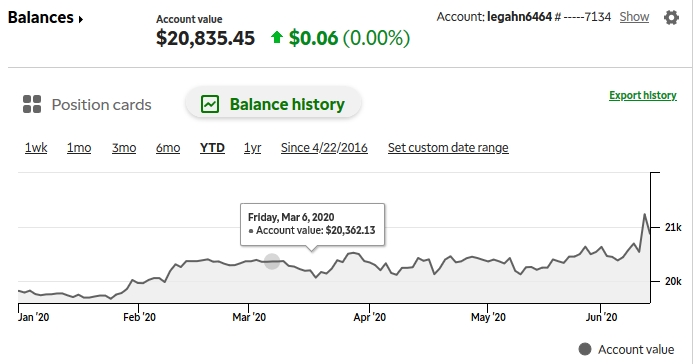

After this our Depot has no downside risk. In the next chart you see the situation in the portfolio analysis of the thinkorswim platform (TOS) on Thuesday 9. June :

Then a heavy correction took place on Thursday 11. June of more than minus 5% in the S&P500. Also the volatilty exploded. But thanks to our hedges our real money depot goes up instead!