In this post – options trading part 2 – we show how to make money with post-earnings. We use Butterflies to play the Post Earnings Announcement Drift (PEADs).

The high season of earnings for Q1 is currently starting. We will now see in concrete terms how the corona shutdown has had a negative impact on the results of the individual companies. And the outlook for the year, in particular, will be critical. Since expectations are relatively low, we will surely have some positive surprises. It is precisely these companies that interest us in connection with the so-called Post Earnings Announcement Drift (PEAD). This has been extensively statistically examined in the literature below.

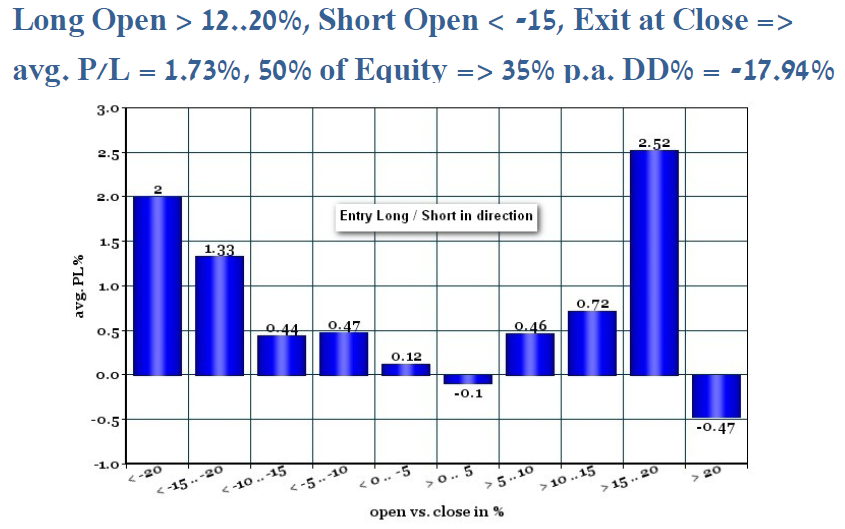

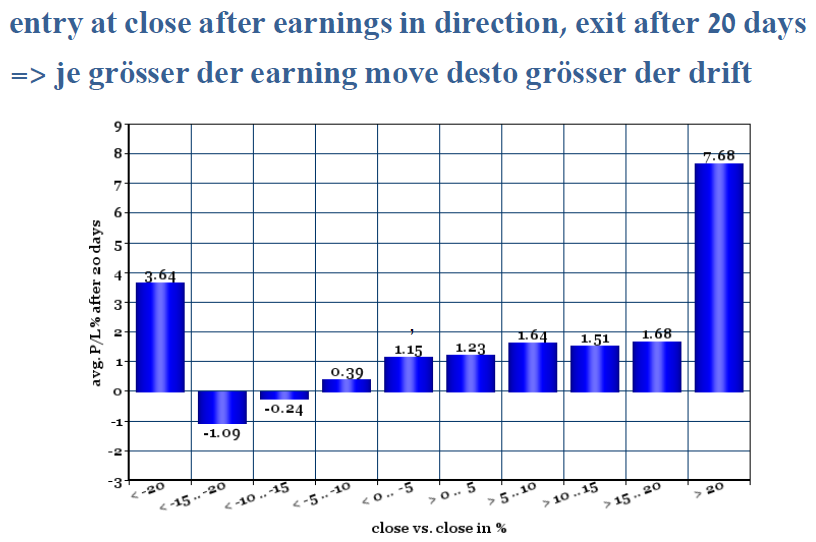

In our own study in 2015, we examined 329 stocks with liquid options for statistical connections between earnings move and price movement. We statistically analyzed 21770 earnings events from 2002 to 2014. Let’s look at some results.

In the next chart, you see the percent open versus close categories after the earnings announcement and the average result in percent if you open a long position at open and closed it the end of the day. If the open is < -15% or > 12..20% the average Profit / Loss is 1.73%. If you trade a maximum of 2 positions daily, you got 35% per year with a drawdown of -17.94%.

The post-earnings announcement drift is not only detectable intraday but also continues for the next 20 days:

On Tuesday 14. April 2020 Johnson & Johnson (JNJ) had earnings before opening. The results for the earnings and sales were better than expected, and the reaction was positive, with a day percent of +4.47.

On optionslam.com you find the last earnings move (only for insider member) for JNJ:

We didn’t set up an out of the money butterfly because we don’t see the potential for a big move of the upside. Instead, we selected a more in the money butterfly. We posted this options trade on StockTwits.