If you want to learn how to make money with stocks the best way is to watch how professional traders do. So for demonstration purposes, we started 2020 with a real money depot.

In Part 2 of how to trade stocks, we analyze our real money depot for January 2020.

1. What are the results of the stock market in January 2020?

January 2020 was not a great month for the stock market. The S&P 500 was about even and the Russel 2000 lost 3.1%. You see in the next chart of the IWM, this is the Russel 2000 ETF:

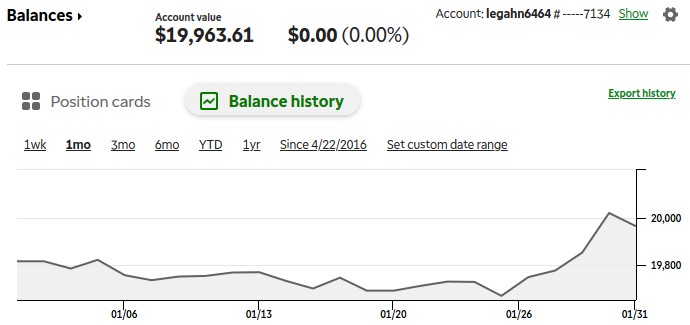

2. How did we do it in our real money depot?

Because we started 2020 with our new real money depot, we are only half invested. But we made 0.74%! Look at our balance in our TD Ameritrade account:

3. How we achieved this?

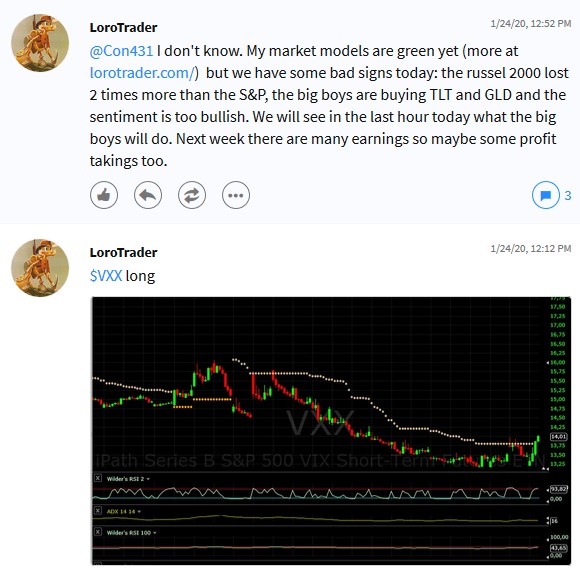

The answer is hedging. On 24. January, we got some bad signals for the stock market, and we decided to hedge our stock depot. So we went long in VXX. The VXX is the S&P 500 short-term Futures ETN. If the volatility goes up, this goes up too. We posted our trade and justification at Stocktwits:

Some of our Market Models changed on 24. January too.

First, the NYSE Percent of stocks above 50 moving average crossed down his 50 moving average (blue line):

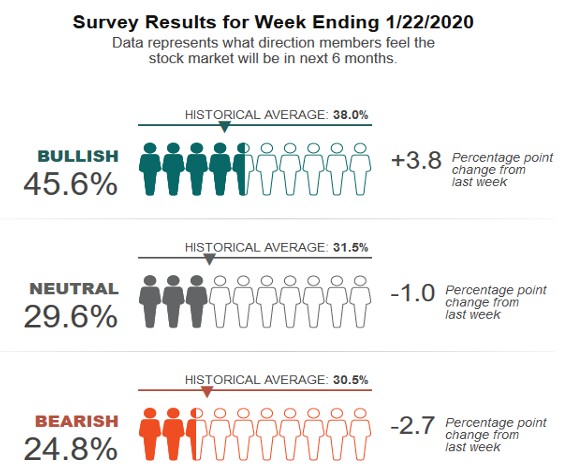

Second, the sentiment was too bullish:

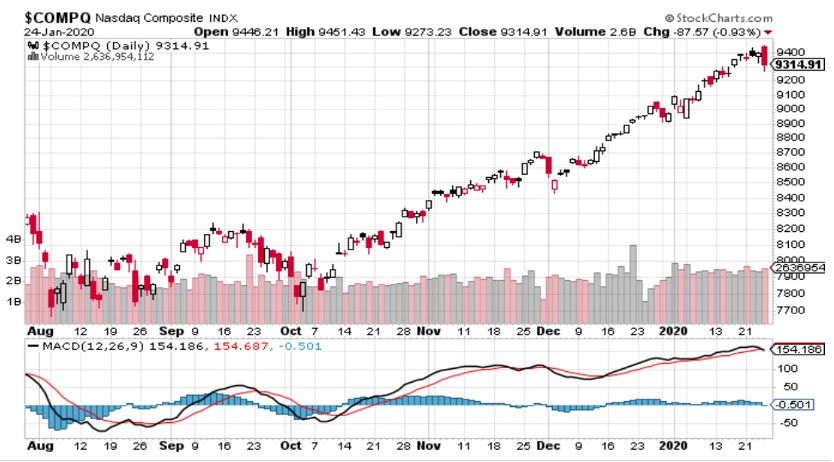

Third, the Nasdaq Composite MACD crossed below zero:

We also bought on 24. January a IWM February Put with strike price 165 for 233 $. The delta of the options was about 0.5. So we hedged a depot with a investment size of 8250 $. The formula is:

investment quote / (IWM Price * 100) = delta, e.g. investment quote = 10k and IWM = 165$ => 10.000 / 16500 = 0.6 delta.

Last Friday out IWM put has a delta of 0.75, so we were over hedged. Therefore we rolled down our put to March 160 strike.

Forward-looking we stay hedged until the price and the volatility leveling out.