In Part 4 of how to trade stocks, we analyze our real money depot for February 2020. And we show how the corona correction affected our real money stocks depot.

February 2020 was a terrible month for the stock market. The S&P 500 dropped about -8%. The corona correction from high to low was about -16%.

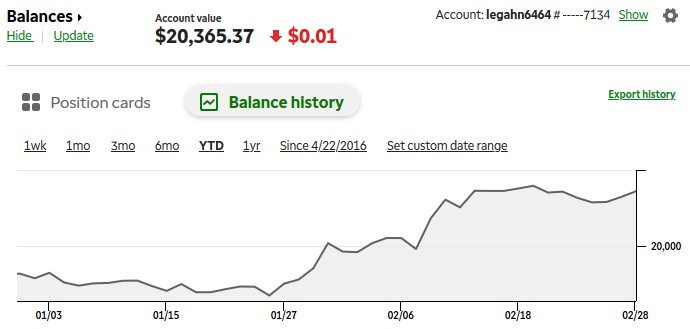

We didn’t follow the corona correction. We made 2.01% in February! Look at our balance in our TD Ameritrade account:

We achieved our outstanding result because we closed most of our long stock positions on date 14. February! Why?

1. the stock market was overheated. The price was in the weakly chart near the upper regressions channels:

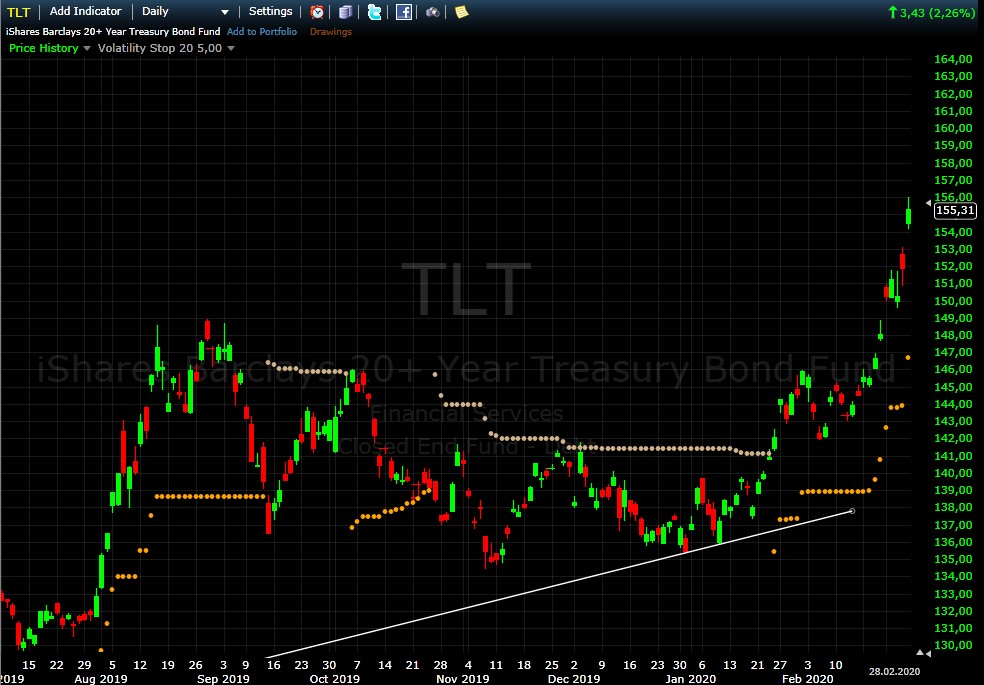

2. the smart money moved to the bond market. In the next daily chart, you see the 20+ Treasury Bond ETF:

3. the market breath was so bad. The next chart shows the Russel 2000 ETF versus the S&P 500 (yellow line). You see that the IWM was relatively weaker. Not a good sign.

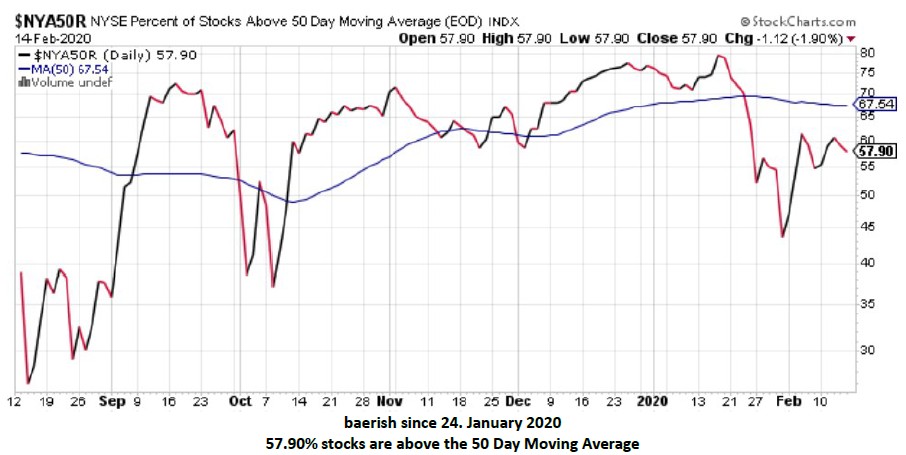

4. the % of stock NYSE stocks < SMA 50 was bearish since 24. January. You can test our weekly Market Model Review.

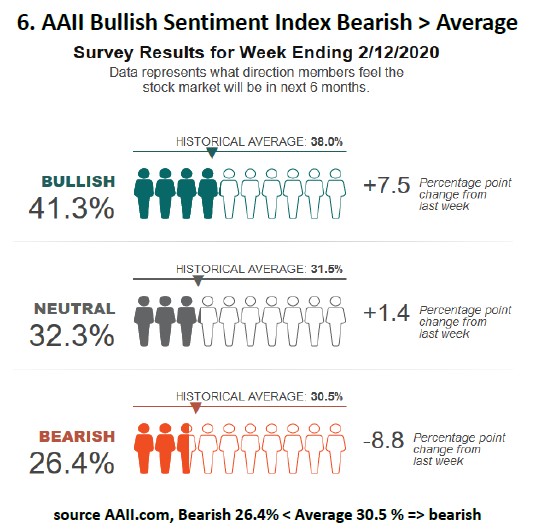

5. the sentiment remained bullish despite bad news:

6. the impact of the coronavirus on the economy was fundamentally clear. Many shares suffered early and understandably from the coronavirus, e.g., RCL, ECL, SBUX, WYNN, DIS, IMAX, YUMC. See the New York Times Artikel form 2. February. It was not surprising for us that the stock market crashed, but that it happened so late.

7. besides, we had to go out on some stocks because of upcoming earnings.

8. the rest is just experience and a little bit of luck.