The Market Models Review has a new feature. Now the Review also shows weekly trends in Commodity, Index, Sector and Bond ETFs.

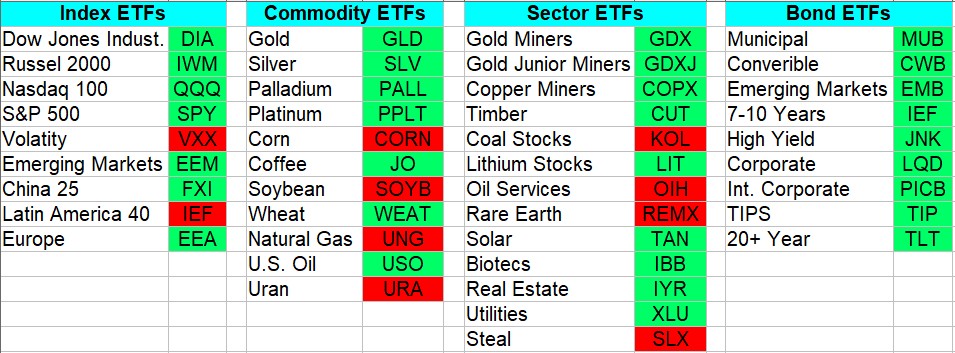

Our Market Models Review is published every weekend. In the next issue, we also show weekly trends in selected ETFs (Exchange Traded Funds). A green background indicates that we have a weekly uptrend and a red we have a weekly downtrend. An uptrend means the close is above the volatility stop. If not, we have a downtrend. The volatility stop is a trailing stop with Close – 5 * Average True Range (ATR) of the last 20 days.

You see the weekly trends in selected Index, Commodity, Sector, and Bond ETFs.

Of the Index ETFs, only IEF and VXX show a downtrend. But a downtrend in VXX is suitable for the stock market.

In the Commodity ETFs, we have a mixed picture. In the precious metals GLD, SLV, PALL, and PPLT, we see a nice uptrend and in CORN, SOYB, UNG, and URA downtrends.

Most of the selected Sector ETFs are in an uptrend. Only KOL, OIH, REMX, and SLX are in a downtrend.

All Bond ETFs are in an uptrend.

If you have suggestions for more ETFs, post it below.

We do not trade weekly trends, but we used the weekly pattern as a filter for our daily trades. In our drop-down analysis, we go daily in the same direction as the weekly trend.

You can test our weekly Market Models Review. Please click here.