In this post – options trading part 1 – we show how to make money in the bear market? We use Cash Secured Puts, Butterflies and Ratio Spreads.

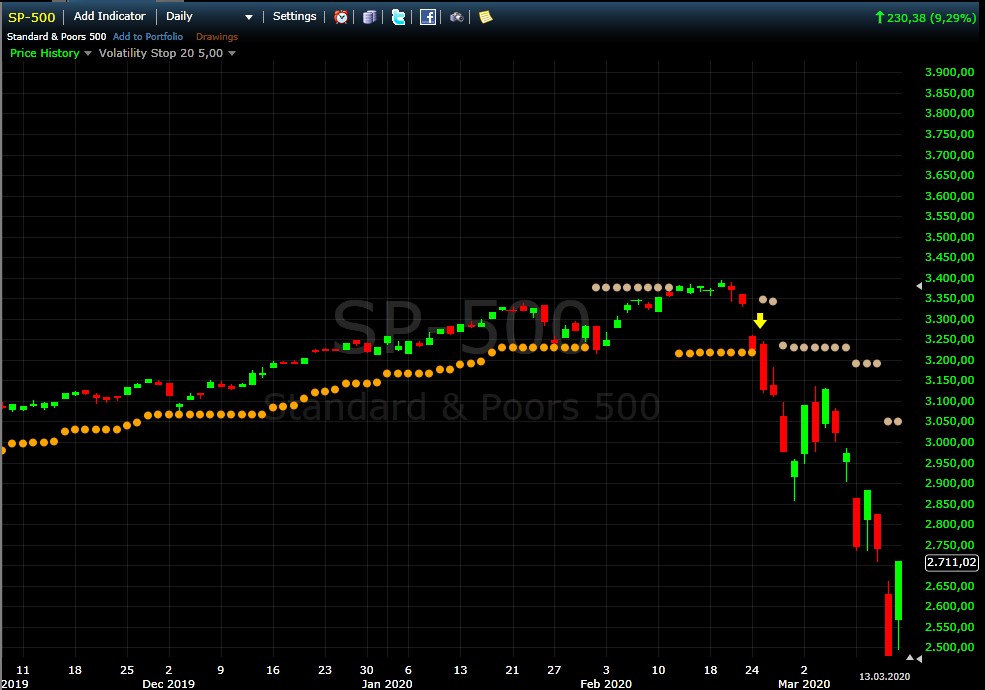

On 25. February (yellow arrow) our Market Models showed we are in a bear market. After this, the S&P 500 lost about 20%.

And the volatility is exploded too:

Because volatility is extremely high, as an option trader, you have a better statistical chance of looking for option strategies that perform better when volatility decreases.

1. Cash Secured Puts

We are not really a fan of this strategy, but in this situation, we can not resist. We sold a monthly June 55 strike Disney (DIS) put for about 300 dollars. The price of this stock lost this year around one-third. The price is today 102.52. Disney has problems in the course of the coronavirus because they have to close some of their center parks, but the new Disney+ channel is a success story. We will see in the next earnings at the beginning of May.

So we will get in June 300 dollars if the stock is above 55$, this would be another bisection, or we will get 100 shares for 55$ each pro one sold put. This looks like a great deal. If you check the Open Interest at this strike, you can see that many options traders have apparently the same idea.

Warning: don’t do this with naked puts, you need to have the cash to buy the stocks. In this case, you need 5500$.

2. Butterflies

Butterflies are a great way if you think the market will be recovered, and the volatility will be lower. In the next chart, you see a NetZero Butterfly in the SPY ETF. The delta is here 20, 40, and 60. We will play this as long as we get more Theta than Delta.

3. Ratio Spreads

We like Ratio Spreads because they have no downside risk. The only danger is if it goes very fast to the upside with no volatility return. You can earn money on both sides. Look at the Starbucks Ratio:

Very Interesting is if you combine a Ratio Spread with a NetZero Butterfly: