In this new series, we present our ETF models from our Signal Service. For every Model, we showed the setup and the backtest.

Today we look at the results if we mix our system together. For this ETF models, we have complete historical Data since 2007:

Loro Adaptive Asset Allocation (LAAA), Blog Signal Service – Part 2

Loro Bond Rotation (LBR), Blog Signal Service – Part 3

Loro Put Call Ratio (LPCR), Blog Signal Service – Part 5

Loro Global Rotation (LGR), Blog Signal Service – Part 6

Loro Defence Asset Allocation (LDAA), Blog Signal Service – Part 7

You receive the entry and exit signals for these ETF models in our Signal Service or in the Loro Scanner.

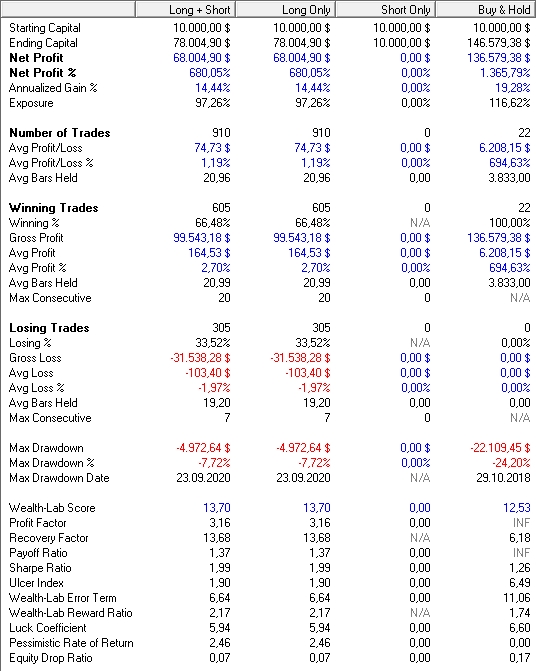

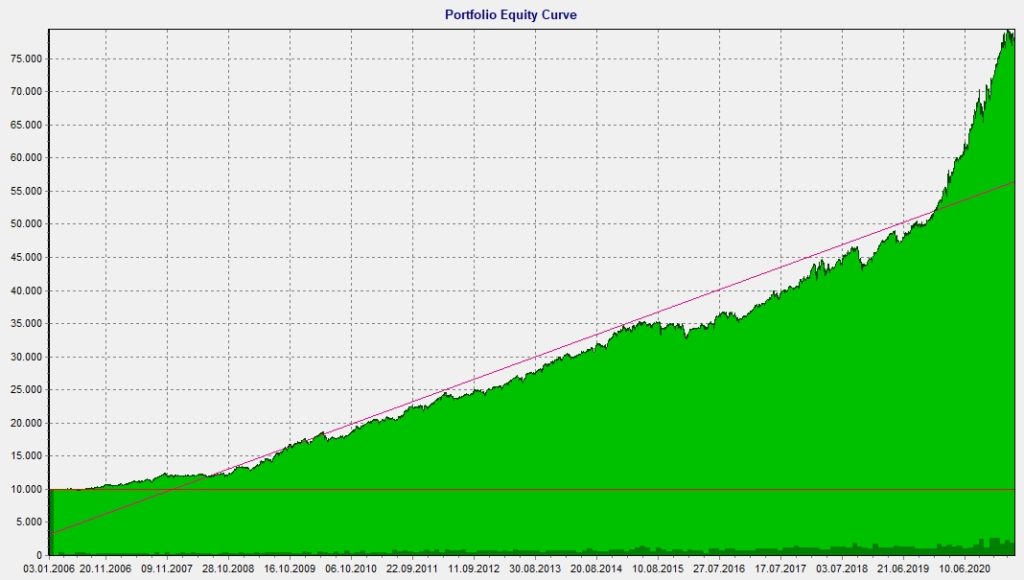

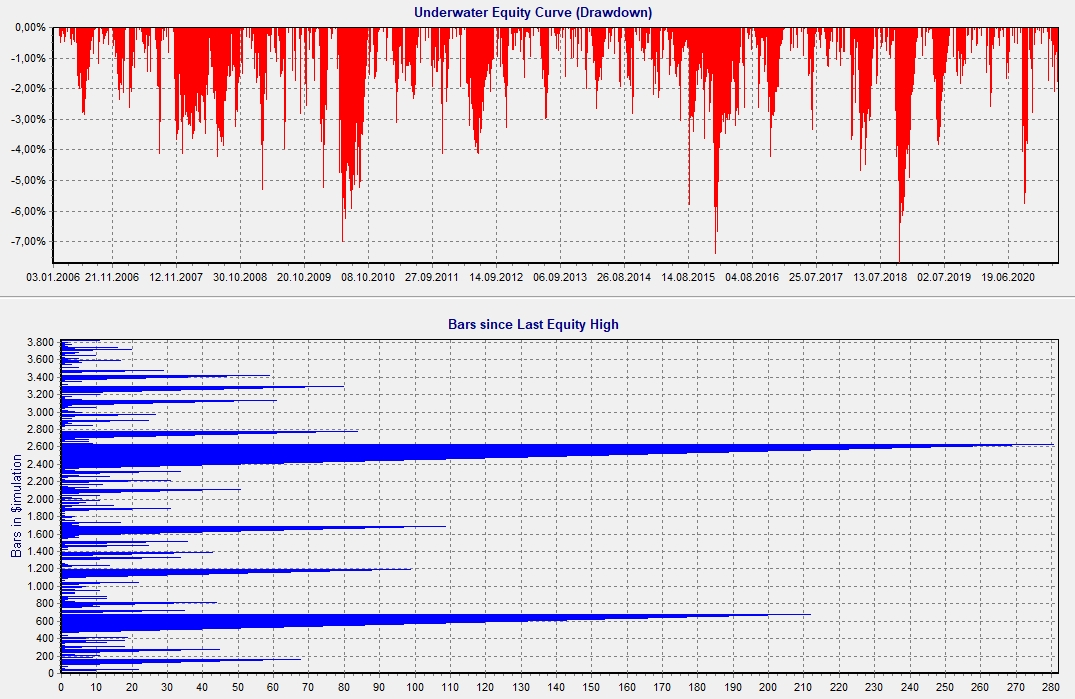

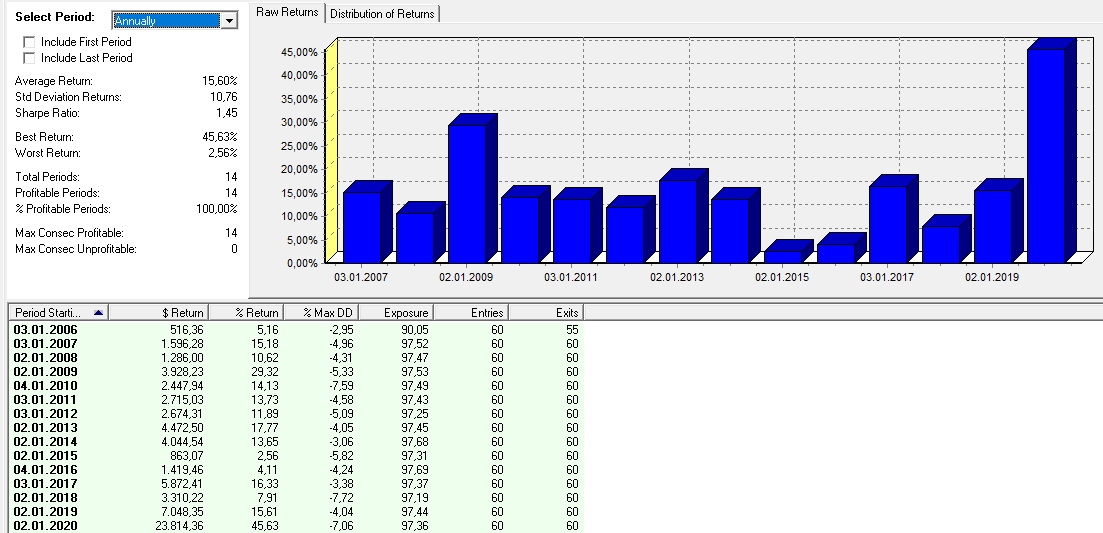

All the Systems have a Revard Risk Ratio of about 1, this means that the maximum Drawdown is like the annual return. But if you mix these systems equal-weighted together with a monthly rebalancing, you get an average return of 15.6% per year with an maximal drawdown of -7.72%. This gives us an excellent Revard Risk Ratio of 2!

You can trade one system alone but better is a mix of systems!